Introduction to Customer Credit Limits

What Are Customer Credit Limits?

A Odoo customer credit limit is a maximum credit given to a customer without seeking further approval. It allows reducing risks and improving revenues. In Odoo, a user can set credit limits directly for inclusion on customer screens. Alerts notify sales personnel once invoices reach limits, and email notifications are sent to managers or authorized persons concerned about credit sales approval and the credit management process.

Why Are Credit Limits Important for Businesses?

Credit limits can certainly be viewed as significant tools for example controlling the risk of not being over extensive on the maximum cap of debt on accounts with customers. They could also be seen as protecting the cash flow for the business by ensuring that outstanding debts at any point in time are limited. They further smooth transactions with customers through ease of defined guiding policies on credit approval. Credit limits seem to give businesses a winning advantage in managing financials, avoiding losses, and gaining the confidence of customers.

Features of Customer Credit limits in Odoo

Set Credit Limits for Customers

Odoo service allows the admin to assign specific credit limits to individual customers directly from the customer screen. This ensures personalized credit control based on customer history and business policies.

Alert Salespersons for Exceeded Credit Limits

When a customer credit limit is exceeded, Odoo automatically alerts the salesperson. Hence, this notification will help decide on appropriate action, from reviewing the customer account to escalating further issues.

Credit Limit Details on the Customers Limit

A dedicated window shows the outstanding invoices from earlier orders and indicates the total amount for the present sales quote. This gives the salesperson an appropriate glimpse of the situation before taking any further action.

Quick Option to Put Customers on Credit Hold

Odoo provides a simple option to place a customer on credit hold if they exceed their limit. This prevents further credit sales until the issue is resolved.

Automatic Email Notifications to Managers

Whenever a sales order exceeds the credit limit granted to a customer, an automatic e-mail notification is sent to sales or credit managers to enable timely review and decisions.

Specific Menu for Credit Sale Orders

Credit sale order users have a separate menu whereby they can view sales orders with customers under credit. It is a one-stop area to track and manage those orders.

Alerts for Customers on Credit Hold

If a credit-hold customer selects an order created on behalf of a salesperson, Odoo fires an alert. This avoids putting in orders by mistake and ensures compliance with the credit policy.

H2: How Customer Credit Limits Work in Odoo

Customer Credit Limit

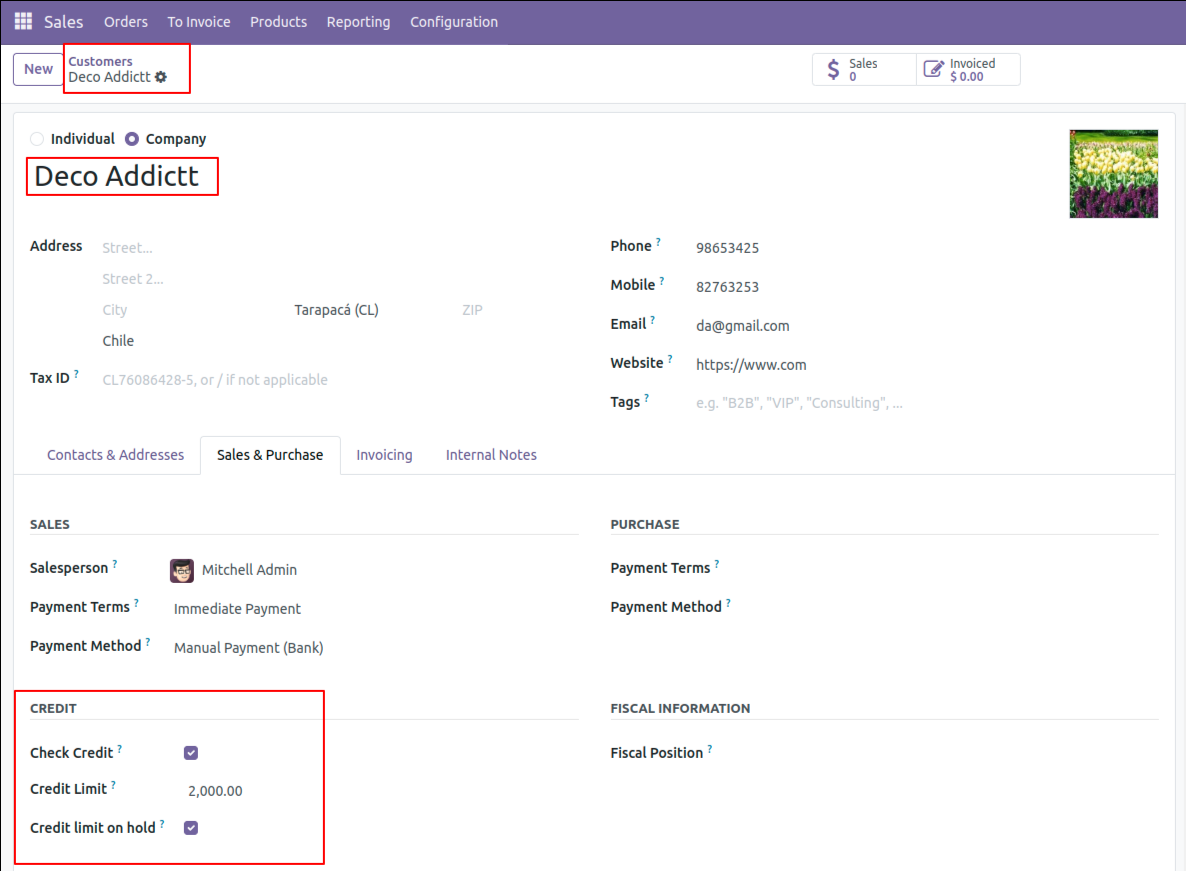

Admins can enable credit limit checking for any customer by selecting the "Check Credit" option in the customer form. Once enabled, the admin can set a specific credit limit for the customer. Without enabling this option, the system will not allow a credit limit to be assigned or enforced.

Exceeded Customer Credit Limit

When a customer credit limit is exceeded, a detailed window appears after clicking the "Confirm Sale" button. This window provides complete information, including:

- The sales order details.

- Invoices that are either unpaid or not yet completed.

If you proceed by confirming the sales order, it will move to a "Credit Limit" state. For customers whose credit exceeds the limit on subsequent orders, you can activate the "Credit Limit on Hold" option to prevent further processing until reviewed.

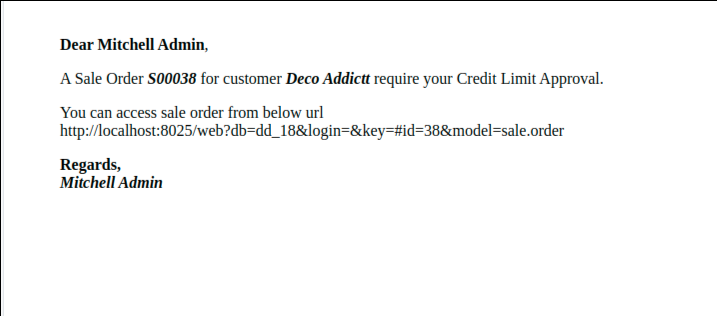

Notify the Sales Manager

Upon confirming the sales order in the Credit Limit window, the sales manager automatically sends an email notification. This email alerts them about the credit status and prompts them to review and approve the sales order.

Sales Manager Confirmation

The sales manager can review and take necessary action on the sales quotation that has exceeded the credit limit. This ensures proper oversight and decision-making on allowing or rejecting the order.

View Sales Orders in Credit Limit

With Odoo, it has a dedicated menu that lists all sales orders for the customers who exceed their credit limit. That menu assists in tracking these sales orders quickly, managing them, and reviewing them in a single point for efficient workflow handling.

They help Odoo developement a complete credit control mechanism for businesses through which they can have effective customer credit management, decreased financial risks, and increased operational efficiency.

Faqs of Customer Credit limit in Odoo

1. What is a customer credit limit in Odoo?

A customer credit limit in Odoo is the maximum amount of credit a customer can use without requiring additional approval. It ensures customers do not exceed their repayment capacity, protecting the business from financial risks.

2. Is there a way to view all credit sale orders in Odoo?

Yes, Odoo provides a separate menu to view and manage all sales orders that have exceeded customer credit limits. This makes it easy for sales and finance teams to monitor and take action.

3. Can Odoo alert me when selecting a customer who is already on credit hold?

Yes, Odoo triggers an alert when you select a customer on credit hold. This ensures that no accidental orders are processed for such customers.

4. Can I adjust a customer credit limit over time?

Yes, you can adjust a customer credit limit anytime by editing their customer form. This flexibility allows you to adapt credit policies based on the customer payment behaviour and business requirements.

5. What are the benefits of using credit limits in Odoo?

Using credit limits in Odoo helps businesses:

- Manage financial risks.

- Maintain steady cash flow.

- Simplify sales approval processes.

- Provide transparency in credit management.

- Strengthen customer relationships with clear credit policies.

6.Why Are Customers Assigned Credit Limits?

Credit limits are assigned to customers to simplify credit management, speed up the sales process, and minimize financial risks. They allow businesses to focus on other tasks by automating credit checks and help improve collection efficiency and cash flow stability.

7.How Are Credit Limits Determined?

Credit limits are determined based on factors like the customer payment history, outstanding invoices, credit score, purchasing patterns, and the business’s risk tolerance. Odoo allows admins to set custom credit limits for each customer directly in their profile settings.

Conclusion:

A business needs to manage the credit limits of its customers so that it becomes financially complete in its activity. The DevIntellecs Odoo App Store becomes a crucial way to have a proficient credit management system, simplifying the setting, monitoring, and enforcement of credit limits without compromising financial stability or customer satisfaction. Such tools allow businesses to mitigate risk, smoothen operations, and create strong customer trust.

Control with Devintellecs Odoo App Store for everything about credit, and enjoy the profit from efficient credit management today!