Loan Management with Odoo Powerful Software

Loan management system is a powerful software that Odoo has created in order to facilitate and attach the loan management process for customers and suppliers alike. The system allows proper recording of loan amounts, interest rates, and repayment schedules for the different businesses in a simple and easy manner. Features that help in maintaining and producing reports or records from loan applications to allocations and repayments make the entire process very convenient and painless concerning financial records keeping and operations. Since this system is integrated with the Odoo accounting module, it generates real-time financial data into the system, which is very helpful for decision-making.

Flexible Loan Management with Automated Notifications & Reports

The system of loan categories is flexible and allows uploading supportive verification documents, as well as notifying the borrower automatically on major benchmarks. Structured Workflow (draft to closure) offers a complete and neat management process without any error. Examples of operational efficiency would be reminders for periodic repayments and detailed journal entries for the instalments recognized. The ability to generate huge, comprehensive reports in PDF format, which include loan summaries and interest certificates, for both electronic and hardcopy purposes, is also available.

With the help of a user-friendly portal, customers and suppliers can make loan requests and view loan details. The system has advanced sorting and filtering options that make it easy to handle loans according to loan type, request date, or status. This is the ideal solution for any business looking to its loan management system in odoo processes when it comes to customer loans or supplier financing.

Features of Loan management system for customer and supplier

- Loan Management

It manages application submissions, approval processes, disbursement of funds, and repayment tracking efficiently. - Lead Management

This would mean securely delivering access by verifying and authenticating personnel, thus ideally limiting logins to authorized persons. - Types of Loans

Create customizable loan types specific to business or customer needs, making the system adaptable for different scenarios. - Borrower Profiles

Keep comprehensive records of borrowers' personal details, eligibility checks, and verification documents for an overview of client information. - Installment Management

Automated reminders for forthcoming instalments for borrowers and conveniently managed repayment status. - Accounting Integration

Generates automatic journal entries for every instalment and the financial records for accuracy and up-to-dateness. - Interest Certificate Generation

Professionally formatted PDF interest certificates based on calculations for borrowers. - Loan Agreement and Notice Templates

Ready-made templates can be filled with different values to quickly and consistently create agreements and notices without manual errors. - Structured Workflow

The loans will all move the same way through a well-defined process from draft to confirmation, approval, disbursement, active status, and eventual closure.

- Automated Notifications

Borrowers and managers will receive timely alerts regarding the due dates of instalments and overdue payments. Hence, there will be a considerably lower chance of missing deadlines. - Advanced Dashboard

Analyze loans with an intuitive dashboard that includes filters, counters, visual charts, and data tables for precise overall performance. - Extensively Detailed Reporting

Essential reports like month-end statements, disbursement details, and interest certificates are all available for download in PDF format. - Digital Signature Provision

The borrower can execute an online loan agreement and notices with a digital signature via the portal, effecting savings on time and a paperless transaction. - Borrower Portal Access

Make a secured online space available for a borrower to refer to a loan agreement, notice, and full instalment schedule. - Automated Invoicing for Processing Fee

Process automatic creation and distribution of invoices to the loan processing fees to alleviate the administrative burden. - Data-Driven Decision-Making

Get informed, thus making sensible decisions for the business and taking action based on advanced dashboards and comprehensive reports that bring insight into loan performance.

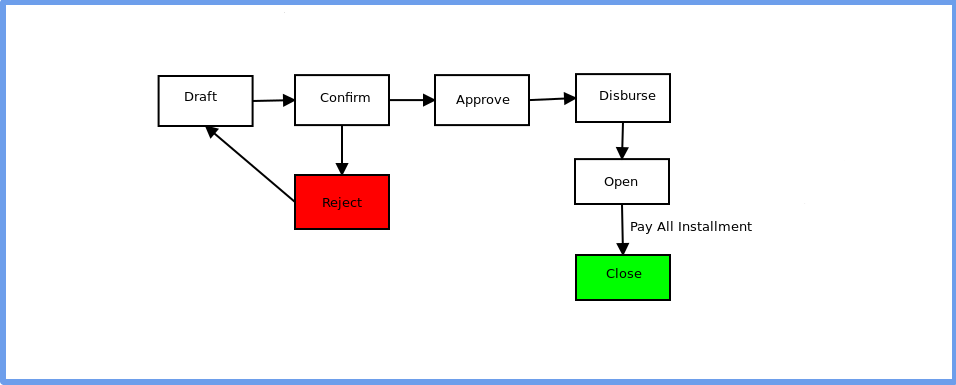

Workflow for Loan Management System

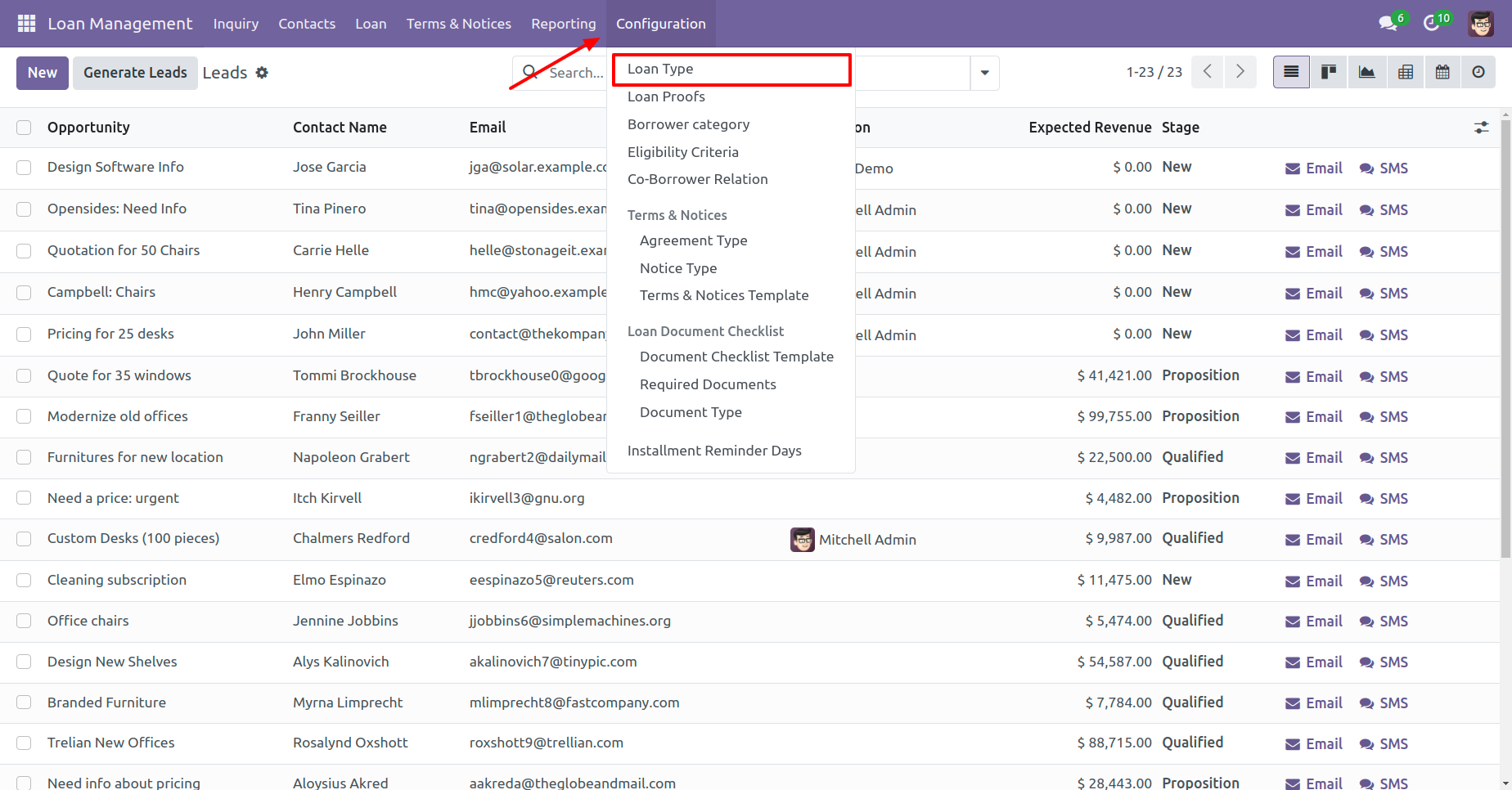

Create Loan Type

Navigate to Loan Management > Configuration > Loan Types.

Add a new loan type with details like:

Loan Name

Interest Rate

Duration (in months/years)

Repayment Method (EMI, Bullet, etc.)

Save the loan type.

Create Loan Proof

Go to Loan Management > Loan Proofs.

Create templates for required proofs (e.g., Identity, Address, Income Proof).

Define the document types to be uploaded by the borrower.

Create Loan Request & Confirm

Navigate to Loans > Loan Requests > Create.

Fill in borrower details (Customer/Supplier), loan type, and requested amount.

Loan proof documents are attached under the Attachments section.

Confirm the request.

Add Loan Documents

The Loan Documents section in the loan request form is used to upload supporting documents.

Ensure all mandatory documents are uploaded before submission.

Loan Request Approve Notification to Loan Manager

Configure notifications for loan requests under Settings > Notifications.

The system sends an email or in-app notification to the Loan Manager for approval.

Reject Loan Request

The loan Manager can reject a loan request if it doesn't meet the criteria.

Navigate to the loan request and click Reject.

Loan Request Reject Reason

When rejecting a request, a pop-up window allows entering the rejection reason.

Reject Reason in Loan Form

The reason for rejection is stored and visible in the Loan Details for future reference.

Approve Loan Request by Loan Manager

The loan Manager reviews the request and approves it.

Navigate to the loan request and click Approve.

Disburse Loan by Billing User

After approval, the Billing User can disburse the loan by clicking Disburse.

Disburse Loan Journal Entry

Loan disbursement creates an automatic journal entry under Accounting:

Debit: Loan Receivable

Credit: Cash/Bank

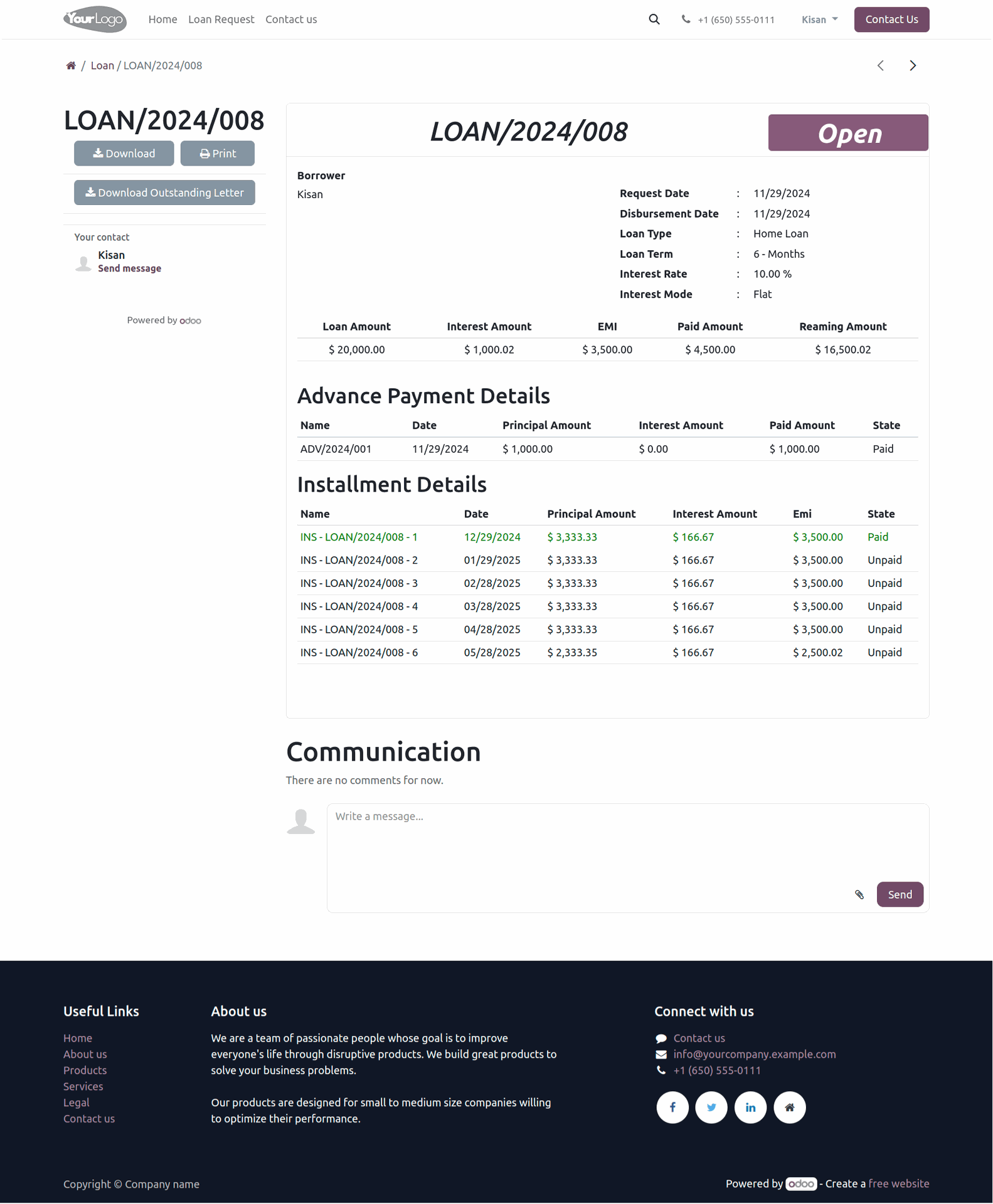

Open Loan

Approved loans move to the Open state, where installment payments can begin.

Pay Loan Installment

Go to Loans > Installments.

Record payment details for each instalment.

Pay Loan Installment Journal Entry

Payment automatically creates a journal entry:

Debit: Cash/Bank

Credit: Loan Receivable

Advance Payment

Borrowers can make advance payments for future installments.

Advance Payment Window

A pop-up window allows users to enter advance payment details.

Pay Advance Payment

Advance payments reduce future installments automatically.

Changes in Last Installment Amount

If the advance payment exceeds the regular instalment, adjustments are made to the final instalment amount.

Update Interest Rate

Loan managers can update interest rates if terms change.

Update Interest Rate Window

A pop-up window captures the new interest rate and effective date.

Loan PDF Report

Generate detailed loan reports by clicking Print PDF from the loan form.

Installment Reminder Days

Configure reminder days (e.g., 5 days before the due date) under Settings.

Send Installment Due Reminder to Borrower

The system sends automated reminders via email or SMS.

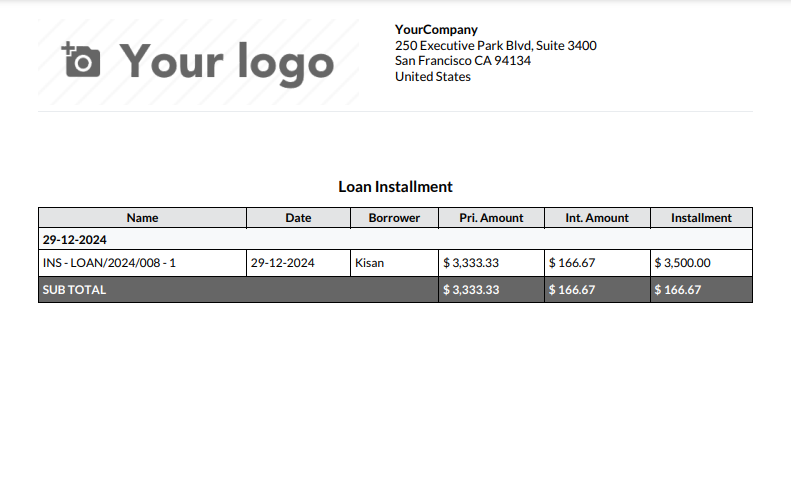

Print Installment Summary Report Window

Go to Reports > Installment Summary > Print.

Select filters for the report.

Installment Summary Report

View a detailed breakdown of all loan installments, including due and paid amounts.

Installment Summary On Screen

The report can also be viewed directly on-screen under Loans > Installment Summary.

Print Interest Certificate

Borrowers can request an interest certificate under Reports.

Interest Certificate Report

Generate and print the interest certificate showing the total interest paid.

Generate and print the interest certificate showing the total interest paid.

Benefits of the Workflow

Transparency: Tracks all loan stages, from request to disbursement and repayment.

Automation: Reduces manual work with automated reminders and journal entries.

Flexibility: Supports adjustments like interest rate updates and advance payments.

Conclusions:

The Loan Management System in Odoo extends the functionalities offered to customers and suppliers to allow a much better and optimized loan process, namely application tracking through settling loans. It automates the entire flow of loans, such as loan requests, approvals, disbursements, and repayment tracking-reduced manual error due to work process digitization and improved transparency and efficiency of operations within the organization.

Devintellecs has come to optimize your loan management process and experience!